Data, innovation and bias: Italy's FemTech report maps the landscape

92 companies mapped for new report

When Valeria Leuti founded Tech4Fem, she wanted to answer a persistent question: why did women’s health remain so invisible in data, policy, and investment? This month, she launched the first FemTech Observatory Report for Italy - a landmark attempt to measure what has too often been ignored.

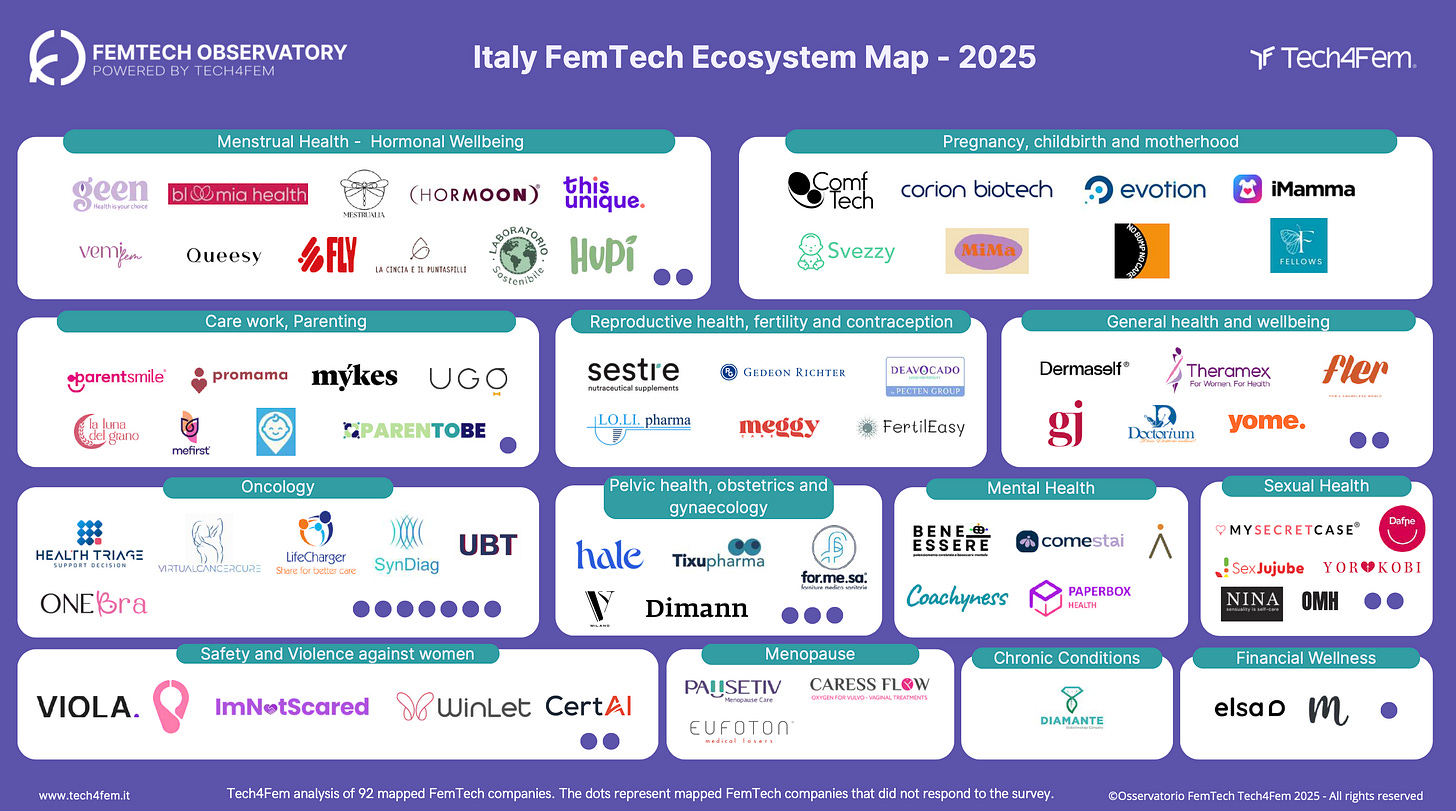

The report maps 92 FemTech entities in Italy, spanning startups, SMEs, and social enterprises, and situates them in a wider international context.

More than 70% are based in northern Italy, and 79% have at least one female founder - a stark contrast to the broader Italian innovation landscape, where fewer than 20% of startups are led by women.

“This report is just the beginning,” Leuti said.

“It’s a foundation to build bottom-up data, give visibility to innovations, and foster global connections. Women’s health is no longer a niche topic—it’s a driver of change for society as a whole”.

Barriers and bias - countering misinformation

Despite its energy, the Italian FemTech ecosystem faces steep barriers reflective of the broader global context too. According to the Observatory report, 92% of companies reported difficulties in communicating their business online. Half said they receive inadequate institutional support, and 85% cited bias or barriers when dealing with stakeholders - from investors to healthcare providers.

Leuti admits one finding surprised her most:

“92% of FemTech companies in Italy have experienced some form of online censorship, a figure that mirrors what the global CensHERship campaign has highlighted internationally. I honestly didn’t expect the issue to be so evident here as well, and across companies in every FemTech segment.”

Censorship intersects with another pressing challenge: misinformation.

“Another key insight that emerged is the strong need for education expressed by all the startups involved, with a significant effort being invested in creating content to counteract the growing wave of misleading and distorted information online, often produced by AI,” Leuti added.

“It will be crucial in the coming years to observe how content on women’s health evolves, ensuring accurate and widespread dissemination that can overcome both bias and censorship.”

The ecosystem in numbers

The report highlights both momentum and fragility:

45% of Italian FemTech companies were founded after 2023, showing rapid growth.

Half report annual revenues under €50,000, with overall turnover estimated between €41–100 million.

38% have raised no external funding, relying heavily on personal investment (64%).

17% of companies have benefited from traditional VC and 28% from business angels.

The most active segments are menstrual health, oncology, pregnancy and maternity, and pelvic health.

Encouragingly, 76% of solo founders are women, and half of all founders are under 35, suggesting a new generation is leading the sector forward.

For Professor Marcella Corsi of Sapienza University, who contributed to the report, the sector is an exception to Italy’s broader struggles with female entrepreneurship:

“We are faced with women who lead companies capable of generating economic value, with highly innovation-intensive business models”.

The global landscape

The Italian findings sit within a much larger and uneven international picture. The report notes that while FemTech has expanded into 13 core segments worldwide - from menstrual health to menopause, oncology, and mental health - investment still lags far behind need. In 2024, global FemTech startups raised $2.6 billion, up 55% from the previous year, with Europe showing the fastest growth in deal value. Yet these sums remain a fraction of healthcare venture capital, with only 2–3% directed to women-founded startups.

Regional differences are stark: North America continues to capture 65% of global capital, while Europe benefits from policy support such as Horizon Europe, and Asia-Pacific shows high consumer adoption potential. At the same time, structural gaps remain: less than 1% of R&D funding goes to women-specific conditions outside oncology, and women still make up only 22% of participants in early-phase clinical trials. The Observatory report argues that bridging these divides is not just about fairness - it represents a trillion-dollar global economic opportunity.