Exclusive: New $5m AthenaBIO vehicle aims to bridge the “valley of death” in women's health

Spun out of AthenaDAO, the new holding company will back 15 early assets across AI, diagnostics, ovarian health, and ReproTech.

When longevity entrepreneur Laura Minquini co-founded AthenaDAO, a decentralised community of researchers, funders and advocates, the mission was clear: fund translational science in women’s health.

Through four cohorts, AthenaDAO’s web3 funders and community has funded around $1.5m in science, supported six labs, seeded two start-ups, 10 fellowships and built a global network through 100 in-person events. It has even backed a program developing AI-driven drug discovery for menopause and supporting the spinout company working on a small molecule therapeutic.

But as Laura explains, AthenaDAO hit its own glass ceiling:

“Our mandate was to fund translational research, not startups. For these maturing assets to have a chance, they need to operate within traditional funding mechanisms.”

Women’s health science is stalling

Laura’s work had revealed a pattern she couldn’t ignore.

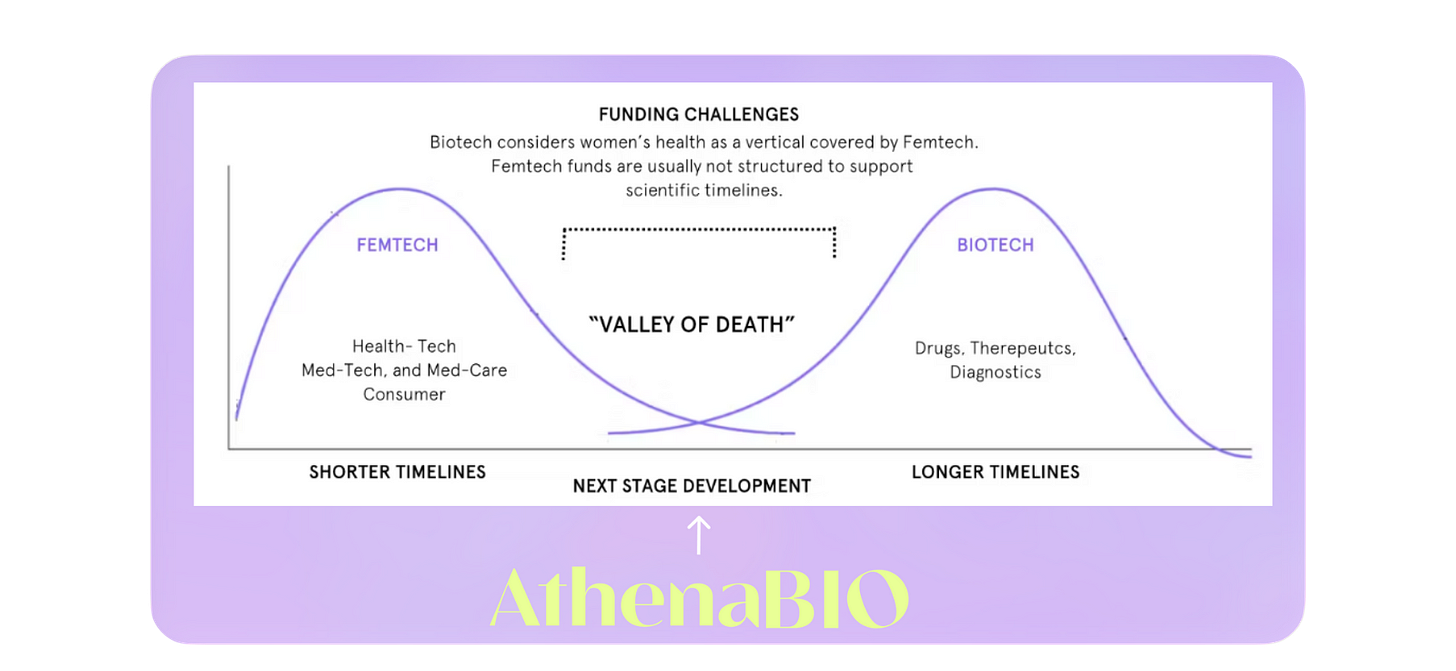

Time and again, she saw promising women’s health research die before it left the lab. Laura calls this the valley of death: the gap between scientific discovery of what’s possible and the commercialisation of that potential.

On one side sits biotech investors accustomed to billion-dollar plays and ten-year timelines. And on the other, femtech investors focused on consumer apps and digital health who don’t have the in-house expertise (or appetite) for deep science.

The result? Assets like AthenaDAO’s promising menopause AI program are too early for biotech, too technical for femtech and risk dying in the lab.

“The reason this is not making it out of the lab is not for a lack of science. It’s for a lack of capital,” Laura says.

AthenaBIO wants to translate it forward

AthenaBIO is the next step: a new equity vehicle being spun out of AthenaDAO, aiming to raise $5m.

“It’s about translation - we need to get molecules and technologies over the first hurdles (like in-vivo experiments and tox studies) so that they’re legible to biotech investors,” Laura explains.

“That’s the stage where too much women’s health science dies.”

Rather than asking investors to bet on a single startup, the vehicle pools equity across ~15 assets already vetted by the AthenaDAO scientific review process, with more pipeline deals to come.

“It’s not a fund.” Laura says “This equity vehicle provides investors with interests linked to up to 15 underlying assets, along with potential additional assets that may be reviewed and approved during the lifetime of the vehicle.”

And the ambition is clear:

“Our vision is to build the first scientific asset portfolio dedicated to women’s health, powered by a differentiated deal flow, rigorous diligence, and a development platform designed to deliver breakthrough therapeutics and strong exits.”

A different kind of vehicle

AthenaBIO will be structured as a permanent capital-style holding company - a HoldCo - rather than a traditional VC fund. That means:

Flexible timelines - not forced to exit within a fixed fund life cycle

Diversification - exposure to multiple assets at different stages

Aligned incentives - investors own a piece of the platform, not just individual deals

Integration with AthenaDAO - for ongoing deal flow, distributed sourcing and early-stage validation.

The minimum ticket size is $100,000 with syndicate options for smaller commitments.

“Our goal is ultimately to have enough of these equity vehicles to build a portfolio that delivers two or three big successes,” Laura says.

“From there, we could scale into a much bigger holding company.”

Four focus areas

AthenaBIO’s thesis is divided into four areas, each designed to balance timelines and risk:

AI: This will be the largest slice and Laura explains that this is the fastest path to proof points and returns, such as AI-driven drug discovery in menopause.

Diagnostics and platforms: infrastructure such as tools that speed up research, non-invasive genetic screening and new imaging techniques.

Ovarian health: tackling ovarian preservation and rejuvenation; diagnostics and therapeutics for ovarian aging, PCOS and endometriosis; stem cell therapy and bioengineering and targeted hormone therapies or alternative non-hormonal approaches.

And finally, ReproTech: This will be the smallest slice. It includes frontier technologies such as artificial wombs or embryo editing - ethically complex, but too significant to ignore.

“AI is the fastest opportunity,” says Laura.

“And means we can make sure we give money back to people sooner rather than later too.”

Why this matters

Women’s health has long been overlooked by biopharma. Laura estimates that fewer than 30% of pharma companies even have a women’s health strategy. And while billions flow into hot areas like longevity or established areas such as oncology, women’s health remains undercapitalised.

AthenaDAO exposed the problem. AthenaBIO is Laura’s attempt to fix it.

“Capital efficiency is key in women’s health,” she says.

“The money is abundant in the world. It’s just hard to come by in this field.”

AthenaBIO is also part of a wave of creative initiatives emerging that recognise that traditional VC isn’t always the right fit, particularly in women’s health. In Europe for example, venture studio DAYA builds companies in-house by matching founders to its own ideas and then providing the support to get the start-ups off the ground.

Looking ahead

The $5m raise may be modest by biotech standards. But for women’s health, it could be a blueprint: a structure that gives investors confidence while giving scientists a chance.

And for Laura and AthenaBIO this is just the start.

“We are laying the next building blocks in our long-term mission to prove that women’s health is the most undervalued growth market opportunity in the life sciences.

“It’s a titan in the making.”