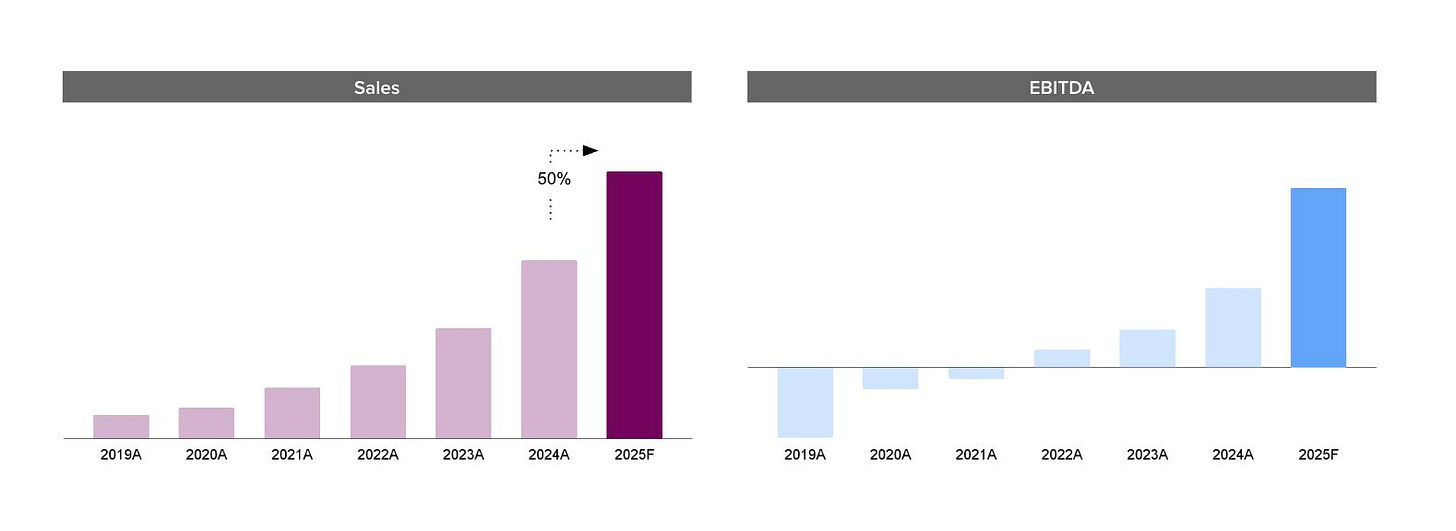

Natural Cycles projects 50% year-on-year sales growth as it gears up for perimenopause mode launch

App launched in 2013 originally for contraception

Digital birth control pioneer Natural Cycles has reported a projected 50% increase in sales for 2025, alongside plans to launch a new perimenopause mode as it expands beyond contraception into midlife health.

The company’s latest financials, shared by CEO Raoul Scherwitzl on LinkedIn, show steady year-on-year growth in both sales and EBITDA since 2019, with profitability strengthening through 2024 and further gains forecast for next year.

“These charts may look like textbook illustrations on what startup financials should look like, except these are actual figures from Natural Cycles,” Scherwitzl wrote.

“On a daily, weekly, monthly basis, nothing feels like a straight line up, but zoom out far enough… Kudos to the stellar team at NC behind those results.”

A new phase: from fertility to perimenopause

Founded in 2013 by Dr Elina Berglund Scherwitzl and Dr Raoul Scherwitzl, Natural Cycles developed the first direct-to-consumer contraceptive app.

Later this month it will now extend its evidence-based model into perimenopause and menopause support too.

Its upcoming perimenopause mode is due for launch in October

Strategic significance

Natural Cycles’ 50% projected revenue growth follows a period of steady expansion taking it well beyond its original ‘prevent pregnancy’ functionality.

While it first became profitable in 2022 its success since has been driven by expansion into postpartum support, further international markets including Brazil this year, and integration with wearables such as Oura and the Galaxy Watch series. The company raised $55 million in Series C funding in 2023 to accelerate product development and global scaling.

Now by extending into perimenopause (as has also been the case for other big name apps such as Clue and Flo Health), Natural Cycles broadens its potential user engagement in the app by arguably a decade or more. That’s a significant strategic move in the femtech sector, where lifetime value has traditionally been limited to the reproductive years.

The shift also positions the company within the fast-emerging digital menopause market, a segment projected to grow rapidly as demand for personalised, non-hormonal, and data-driven care increases.