World Economic Forum launches women's health investment index

Ties in with release of new women's health investment outlook

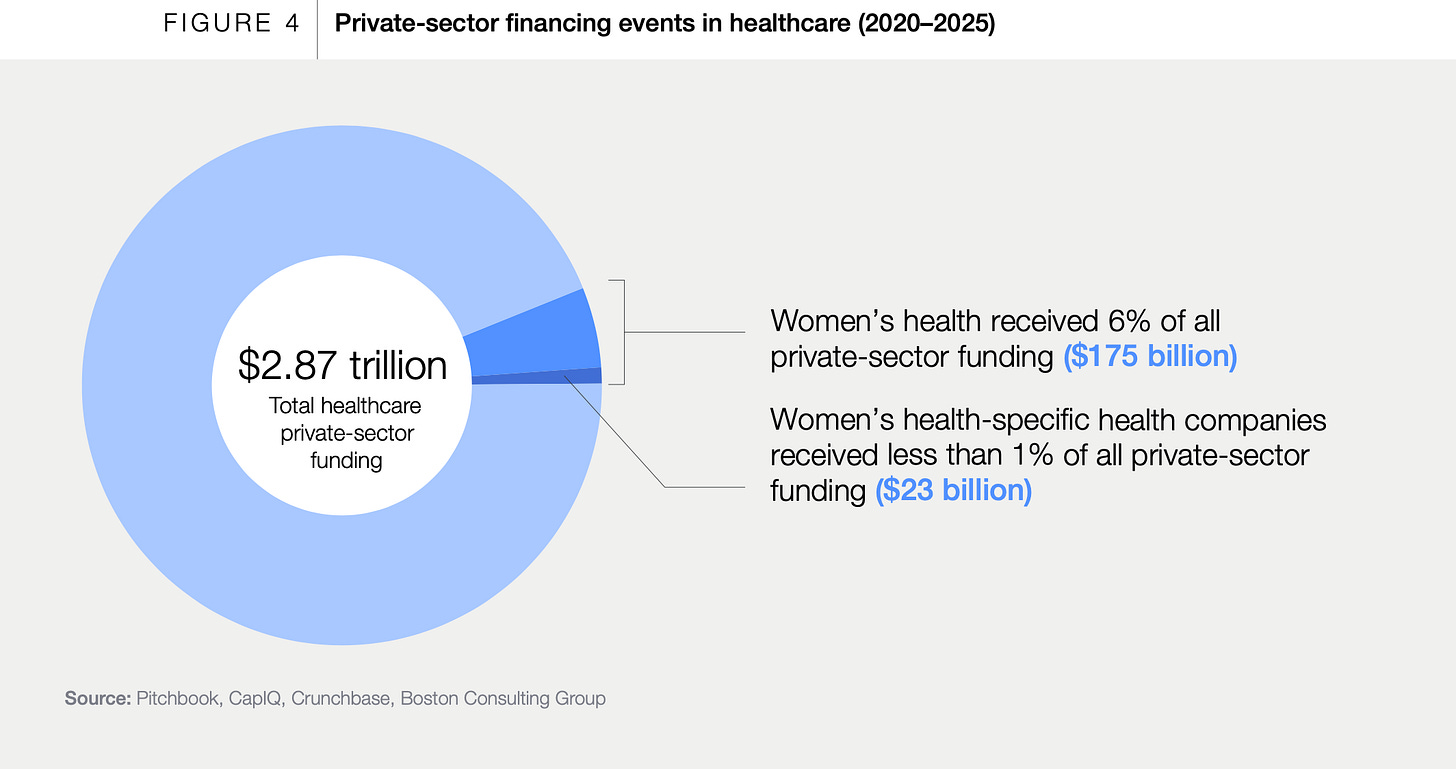

Women and girls account for nearly half of the global population. Yet just 6% of private healthcare investment is directed towards women’s health — and less than 1% goes to companies focused exclusively on women’s health.

Those figures sit at the centre of a new report from the World Economic Forum, produced with Boston Consulting Group, ‘The Women’s Health Investment Outlook’ which sets out to answer a basic question: if women’s health represents such a large share of healthcare need, why does capital barely touch it?

The answer, the report argues, is not a lack of opportunity but a lack of visibility.

Launching a new Women’s Health Investment Index

A key intervention in the report is the launch of the Women’s Health Investment Index, a new dataset that tracks private-sector investment into women’s health over the past five years.

Until now, women’s health investment has been hard to pin down. Deals are scattered across therapeutic areas, definitions vary, and women-focused products are often buried inside broader healthcare portfolios. The index pulls those threads together, showing clearly where capital is flowing — and where it is not.

The comparison the authors make is with climate finance. As the report explains:

“Before climate finance mapping, climate investments also suffered from fragmented data, unclear value pathways and perceived risk. [….] Once transparent data emerged, climate investments nearly doubled.”

The report does not claim the same outcome is guaranteed for women’s health, but it makes the point that markets cannot function properly if investors cannot see them.

Overlooked conditions

Around 90% of private investment into women’s health has gone into three areas: reproductive health, maternal care and women’s cancers.

Meanwhile, some of the highest-burden conditions affecting women remain largely overlooked. Cardiovascular disease — the leading cause of death among women globally — attracts only a sliver of women-specific investment. The same is true for metabolic disease, osteoporosis, menopause and neurological conditions such as Alzheimer’s disease, despite clear evidence that these conditions affect women differently from men.

“Cardiovascular disease is the leading cause of death among women, yet investment in women’s cardiovascular health accounts for less than 0.01% of overall cardiovascular funding,” explains the report.

The economic implications are substantial. An analysis by Boston Consulting Group suggests that addressing just four conditions — cardiovascular disease, osteoporosis, menopause and Alzheimer’s disease — for women in the United States could unlock more than $100bn in market opportunity by 2030.

And to counter the idea that women’s health markets are too fragmented to scale, the report points to IVF. Once viewed as experimental and controversial, IVF is now a global, multibillion‑dollar industry. Although it’s not a template for women’s health, it’s evidence that markets previously thought of as niche can mature when data, policy and capital move together.

“IVF illustrates how scientific reliability, increased demand and regulatory and reimbursement traction can turn a niche market into a multibillion-dollar global industry,” explains the report.

Early positive signs

Finally, the report acknowledges that VC funding in women’s health is beginning to rise and that exit data shows returns in women’s health are broadly in line with the wider healthcare market.

As the report states:

“The business case for women’s health is clear and compelling. Significant white space remains across therapeutic areas and delivery models, offering investors the chance to shape a high-growth, underdeveloped market.

“Aligning capital with innovation will not only unlock meaningful financial returns but also create durable value across the broader health economy.”

Interesting timing and alignment with the AOA Exit Report: https://aoadx.com/exit-report/

I haven't fully digested the WEF analysis, but it feels like the conversation between the two reports is:

AOA: “Women’s health works when funded correctly.”

WEF: “We still aren’t funding what matters most to women.”

Love the attention for women's health. I'd also appreciate your thoughts on why we're seeing two funding reports on women's health around the same time. Something to talk about at big conferences?