💌 Issue 129: $100bn of women's health exits | Pomelo Care's $92m Series C | the menstrual blood-based precision health platform | prediction into pregnancy care

The global weekly briefly on women's health innovation and Femtech

Welcome to issue #129 FutureFemHealth, (w/c January 12 2026) - we’re trusted by 9,000+ investors, innovators and leaders to decode the funding flows, breakthrough ideas and policy shifts transforming the sector.

Did you miss our 2026 expert predictions last week? Catch up to find out what 19 leaders in women’s health told us about what to expect in the year ahead.

🌟 In this week’s briefing:

🚀 $100 billion of women’s health exits - new AOA Dx report

🏆 Pomelo Care raises $92m Series C

🩸 Xella Health raises $3.7m pre-seed to build menstrual blood–based precision health platform

🤰🏼 Wellcome Leap and Medicines360 team up to bring prediction into pregnancy care

Got news to share from the world of FemTech and women’s health innovation? Let me know at anna@futurefemhealth.com

🚀 Women’s health reaches $100 billion in exits

Exits are the most elusive proof point in women’s health - a key metric for success, you’ll often hear sceptics say that they need to see more exits in the sector to be fully convinced of its potential.

Well, here we go.

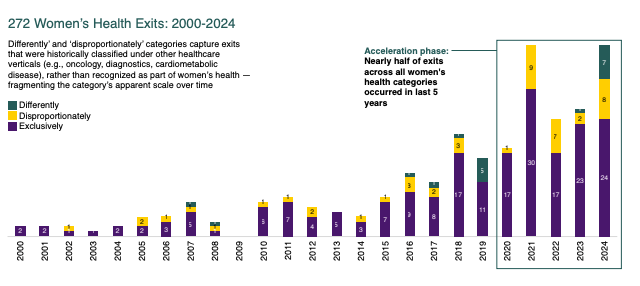

A new report from AOA Dx ‘Follow the Exit: Why women’s health is a smart bet in healthcare’, has mapped the first comprehensive analysis of women’s health exits, identifying over $100 billion in disclosed value since 2000.

The team estimate the actual figures are far higher due to incomplete records.

Nearly half of the 272 mapped exits occurred in the last five years, showing how the market is also accelerating. 2024 alone saw $21.4 billion in value through exits. And that’s not including the $18.3 billion deal to take the women’s health diagnostics company Hologic private in 2025 - with last year set to be the biggest exit year on record.

Throughout, diagnostics, biopharma and devices add up to nearly 80% of total exit value - with diagnostics outperforming industry benchmark norms for deal size.

But, here’s the key point if you’re reading this and wondering why we didn’t know all this before: it’s because previously women’s health was so narrowly defined that a lot of these exits weren’t even ‘counted’ as a women’s health success story.

“Legacy misclassification - particularly in oncology, diagnostics and chronic disease - caused many women’s health exits to be tracked outside the category, understating its historical scale and creating pricing inefficiencies for investors,” says the report.

Now I love a good January report launch to kick-off the year (who can forget the landmark McKinsey report of 2024?!) and I have a feeling this new report from AOA Dx is likewise going to set the tone for 2026. Finally, it’s time to reclaim what has always been there - women’s health as a solid bet with clear existing success.

So, what next? The reports sets out that the opportunity now is to align the capital, policy and innovation with the true scale of needs and outcomes. Alzheimer’s Disease, GLP-1 agonists and metabolic health, and cardiac disease are all highlighted as essentially unclaimed markets.

“For years, women’s health has been framed as an emerging opportunity, despite decades of meaningful commercial outcomes,” said Anna Milik Jeter, Co-Founder of AOA Dx.

“What’s been missing isn’t performance, it’s measurement.”

(Continue reading: AOA Dx to download the report)

More reports on my radar this week:

The business case for accelerating women’s health investment by Women’s Health Access Matters. Estimating a $58b market by 2029 (up from $45.5b in 2025), WHAM has tracked the high-return opportunity in women’s health. It also suggests that $350 million invested into research focused on women could translate into $14b in economic returns across Alzheimer’s disease, lung cancer and more. The lists of success stories in women’s health starting on page 21 are particularly useful! (Continue reading: WHAM)

‘Accelerating private capital investment in women’s health’ by Kearney. This report says that while women’s health has entered the radar of private investors now, capital is still concentrated in a narrow set of opportunities such as fertility and breast cancer. Kearney suggest diagnostics and tech-driven innovations in particular remain undercapitalized. It says the next investment frontiers are hormonal and gynecological health, including menopause management, and conditions that affect women differently. (Continue reading: Kearney)

✅ Let’s partner in 2026

Each month FutureFemHealth reaches 100,000+ women’s health innovators in 107+ countries across our newsletter, social media channels and website.

We are not a mass media channel, we are a high-trust, highly-targeted briefing read by the people who are building, funding and shaping women’s health.

In 2026 we have a limited number of partnerships for organisations who want to:

Lead the narrative on complex and/or emerging women’s health topics

Build credibility and trust with industry peers - founders, operators, clinicians and investors.

Engage leaders through thoughtful content that sparks connection, conversation and collaboration.

📩 We’re now opening 2026 partnership slots. To explore opportunities or request our media pack contact: anna@futurefemhealth.com

💰 Capital flows: where are investors placing bets?

📌 U.S: Pomelo Care raises $92 million Series C to expand beyond maternity into multi-stage women’s health. A huge Series C round to kick off January! Founded in 2021 by Marta Bralic Kerns, and now supporting nearly 7% of all births in the U.S, Pomelo wants to take its proven model of virtual, proactive and evidence-based care into other areas - including menopause. From a payer perspective, Pomelo says engagement with its programs is associated with a 3–5x return on investment, driven largely by reductions in high-cost events such as NICU stays and emergency visits. “Pomelo has reached national scale at an unprecedented rate” says Ron Shah, partner at Stripes, who led this funding round, which takes Pomelo to a $1.7 bn valuation. (Continue reading: FutureFemHealth)

📌 U.S: Xella Health raises $3.7m pre-seed to build menstrual blood–based precision health platform. Menstrual fluid holds a treasure-trove of information that traditional blood tests might miss. Xella Health combines menstrual blood testing alongside traditional blood testing for longitudinal data analysis. It speaks to the growth of ‘pattern spotting’ in at-home tests that can uncover insights over time for precision health - from undiagnosed symptoms, peri/menopause, fertility and reproductive health, through to gynae cancer risks. Ahead of a Spring 2026 launch of its diagnostics platform Xella also says it’s closing in on a 10,000 women waitlist. This round was led by Precursor Ventures. (Continue reading: FutureFemHealth)

📌 FRANCE: BrightHeart bags €11M to expand FDA-cleared AI ultrasound platform across the US and Europe. Brightheart’s AI software platform supports the entire ultrasound exam and reduces the number of incomplete fetal heart scans by 47%. A bonus for clinicians - the FDA-cleared medical device integrates directly into routine ultrasound workflows and saves time too. This Series A round was co-led by Odyssee Venture and GO Capital. (Continue reading: Tech.eu)

🌟 Industry moves and strategic shifts

📌 U.S / GLOBAL: Wellcome Leap and Medicines360 team up to bring prediction into pregnancy care. Too many stillbirths happen in pregnancies with no obvious risk factors. This new partnership aims to change that by fast-tracking into commercialisation new screening tools including biomarker tests and eye-imaging tech that can surface the danger earlier. It will draw upon scientific discoveries from a previous Wellcome Leap program launched in 2022. Notably it aims to do in years what it says usually would take decades. “By combining Wellcome Leap’s scientific breakthroughs with Medicines360’s global innovation and access model, we can deliver predictive tools to mothers around the world – before complications arise. Before it’s too late.” (Continue reading: Wellcome Leap)

📌 U.S: Two major partnerships expand access to Visby’s at-home sexual health test for women. Unlike many at-home tests, Visby’s palm-sized device delivers test results from home in just 30 minutes without the need to mail in samples. That matters for STIs, which are common but chronically undiagnosed, and where traditional testing suffers from stigma, scheduling barriers and privacy concerns. Now, new agreements for Visby mean that consumers can purchase the tests via Quest and Labcorp OnDemand. (Continue reading: FutureFemHealth)

📌 UK/ GLOBAL: Human eggs ‘rejuventated’ in an advance that could boost IVF success rates. The decline in egg quality is the main reason that IVF success rates drop so steeply with age and why chromosome disorders increase. New research from Ovo Labs has suggested that supplementing eggs with a key protein reduces these age-related defects, raising hopes of improved IVF for older women. When eggs donated by fertility patients were given microinjections of the protein, they were almost half as likely to show the defect compared with untreated eggs. The next step is to confirm results in more extensive trials - a preprint (without the gold standard peer review) has published the results so far. (Continue reading: The Guardian)

📌 GLOBAL: What 2025 taught us as private equity investors in women’s health. A look back at some of the major deals of the past year. What’s notable is that the largest - involving Hologic and Hinge Health for example - involved companies that don’t brand themselves as women’s health. Once again we see, women’s health was never niche, it was just hiding in plain sight. (Continue reading: Maria Molland on Medium)

📌 U.S: OpenAI unveils ChatGPT Health. The limitations of large language models in women’s health are well documented: biased data in, biased outputs out. That makes the efficacy of OpenAI’s new tool very much an open question. But as AI becomes even more embedded as the ‘interpreter’ of our symptoms, test results and care pathways, I think the growing priority is digital health literacy. Consumers need to understand the risks, the limits and the uncertainties of these systems - what they can do, what they can’t and when answers should be questioned. Without that, we risk a whole new layer of harm in the women’s health landscape. (Continue reading: TechCrunch)

This week’s poll:

Our last poll asked: What word do you most associate with women’s health in 2025? The top answer was a split between momentum (31%) and political (31%) with ‘exciting’, ‘challenging’ and ‘not niche’ featuring as runner-ups.

🩸 Research and women’s health news

📌 UK: ‘I’ve been denied cervical screening four times’. Emily Salter, a wheelchair user, says she has given up trying to have a cervical screening after finding she could not get inside a treatment room. Her appointments have each time been cancelled due to accessibility issues. A timely reminder of the importance of access in healthcare (and an opportune moment I’d say for an at-home test provider to get in touch with Ms Salter). (Continue reading: BBC)

📌 U.S: New York-Presbyterian receives $20 million gift to launch women’s health centers. Entrepreneur and philanthropist Emilia Fazzalar’s gift will help to establish a new women’s health program aimed at delivering coordinated, lifelong care, with a particular focus on perimenopause and menopause. The initiative will expand access to integrated, multidisciplinary care for women across Manhattan and Westchester. (Continue reading: NPY.org)

📆 Save the date

If the big conferences in the U.S like CES and JPM have given you FOMO this month, and if you live in and around London then we’ve got several events that might be of interest:

100 Female founders: Health innovators. AI in women’s health. London, Tuesday 24 Feb, 8am-11am GMT. Barclays, Shoreditch.

🎟️ Register here.

100 Female Founders : Women’s Health Innovators. Fundraising + GTM. London, Wednesday 28 Jan, 8am-11am GMT. Barclays, Shoreditch.

🎟️ Register here.

The Women’s Domain: CensHERship and the Femtech Economy. Navigating the digital barriers in women’s health. London, Thursday 26 Feb, 6pm GMT. London Bridge. (I’ll be joining my CensHERship co-founder Clio Wood to speak at this one!)

🎟️ Register here.

📦 New in the FemTech Files

‘The FemTech Files’ shares the critical data from different women’s health verticals and product types. They were published using Dr Brittany Barreto’s FemHealth Insights database and created by FemHealth Fellows. This week sees the release of part nine - the final part - of the series:

If you missed any parts in the series, head over to Dr Brittany Barreto’s LinkedIn profile where you can discover all of the FemTech files including a bonus landscape report too.

That’s all for this week! If you’ve missed any previous newsletter issues catch them all at futurefemhealth.com and do make sure to follow us on LinkedIn and you can connect with me directly.

Anna

Before you go: Want to partner with us? To explore opportunities or request our media pack contact: anna@futurefemhealth.com