2025 in review: 17 defining moments that will shape women’s health in 2026

We’ve passed the inflection point in women’s health and the foundations have begun to take shape.

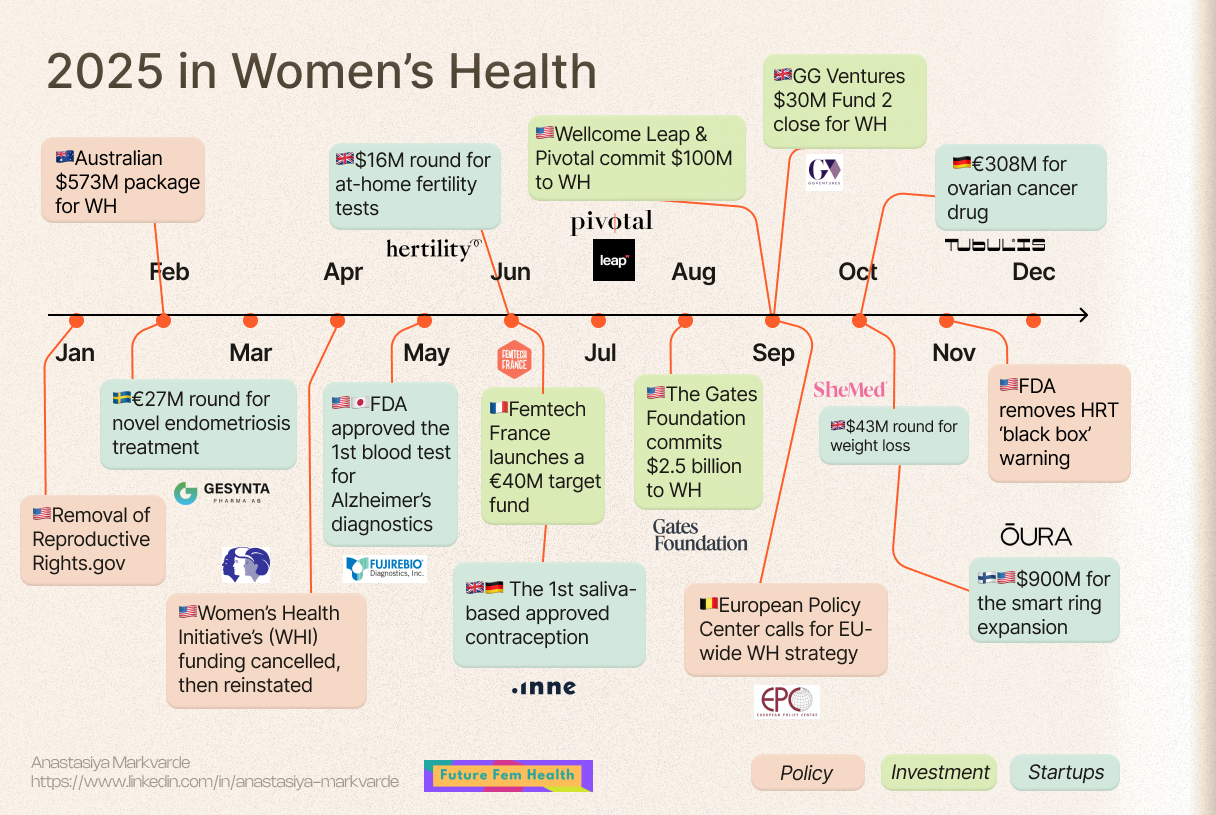

If 2024 was the year that women’s health finally broke into the mainstream, 2025 was the year it began to harden into infrastructure. Serious movement of capital (though still not nearly enough). Governments and philanthropy stepping up. Shifting regulations. And the definition of women’s health finally feels like it is pushing beyond being seen as ‘just’ reproductive health - expanding into chronic disease, metabolic health, brain health. We’re in a phase of reframing women’s health across all ages and stages of life.

In this article, FutureFemHealth’s Anna O’Sullivan and women’s health strategist Anastasiya Markvarde select their top 17 defining moments of 2025 that will continue to shape the future of women’s health in 2026 and beyond.

While some of these moments are single decisions or deals, others are clusters of signals that, taken together, mark a clear change in direction.

What would you add? Let us know in the comments section.

1. The Gates Foundation committed $2.5 billion to shape the global research agenda

Philanthropy has stepped up in 2025 to plug the gaps in the gender research gap. The defining funding moment was The Gates Foundation $2.5 billion commitment to maternal, menstrual, gynaecological and sexual health - with particular focus on low- and middle-income countries.

The Gates’ commitment wasn’t a standalone. Pivotal Ventures and Wellcome Leap announced a $100m programme for women’s health research; ICONIQ launched a $100m Co-Lab and Wellcome Leap unveiled a $50 million program to halve Alzheimer’s risk in women.

2025 also saw new capital structures emerge to push women’s health beyond early-stage funding. The launch of the Women’s Health Fund, a fund of funds planning to invest in 15 specialist funds, aims to activate fund managers collectively controlling $60 billion in assets under management. Rather than backing individual startups, the model is designed to reshape how institutional capital flows into the sector — a signal that women’s health is beginning to be treated as a durable asset class rather than a thematic bet.

Together, these investments show a more coordinated capital stack: with philanthropy setting the agenda at a global level for research into women’s health, and new capital structures like the fund of funds ready to translate that research agenda into sustained, institutional investment.

2. Governments showed up for women’s health

Worldwide, Governments have increasingly shown that they finally understand that women’s health is population health and an economic priority. Australia announced a $573m package for women’s health, including new subsidies for contraceptive pills and hormone therapy. The UK Parliament voted to decriminalise abortion and confirmed the much-anticipated Women’s Health Strategy would be renewed. The Netherlands launched a €27.5 million strategy to improve women’s health research. And Denmark committed DKK 160m ($23.4M) to launch a women’s health research centre.

Taken together, this support will provide a crucial foundation for in-country innovation.

3. Trump returned to office - women’s health feels the impact of politics

The political impact of the U.S in 2025 has been inescapable. When President Trump returned to office ReproductiveRights.gov vanished - taking with it federal guidance on abortion and contraception. The global gag rule was reinstated, cutting funding to organisations even mentioning abortion care - affecting countries where one in three women of reproductive age live. And federal research projects on uterine fibriods and pregnancy risks were halted as a ‘focused on gender.’

The speed and depth of changes has been a reminder that women’s health is deeply exposed to political ideologies.

4. FemTech France announced a dedicated femtech fund with €40 million target

FemTech France, a non-profit ecosystem player, launched the first French investment fund dedicated entirely to women’s health innovation, setting a target size of €40 million. Anchored by an initial €5 million commitment from the Île-de-France Region, the fund aims to finance startups in the areas such as endometriosis, fertility, menopause, and female cardiovascular health.

What’s significant with this moment is the role of an ecosystem builder such as FemTech France facilitating investment into women’s health. It’s the first femtech-focused fund on the continental Europe, backed up by the government, and is a great sign for the continent and the importance of the topic on the state level.

Similar ecosystem networks launched in 2025 including FemTech Spain and FemTech Portugal - all brought together under the umbrella of FemTech Across Borders (FAB).

5. Hormone monitoring broke out - and the first saliva-based contraception in Europe secured regulatory approval

Hormonal health innovation has arguably been the most defining women’s health trend of 2025 (see Anastasiya’s dedicated article and market map here)

According to the European Femtech Map, hormonal health is the fastest growing area in women’s health innovation in Europe alone. Startups from the segment - from the continent and beyond - are developing innovative hormonal blood-, saliva-, urine tests as well as wearable trackers, from patches to earrings, giving women the opportunity to track their hormones for fertility, health or lifestyle purposes.

A major milestone came when Berlin- and London-based Inne got regulatory approval in the EU and UK as the first saliva-based contraception for women who cannot or choose not to use traditional methods. Inne’s device tracks progesterone levels through daily saliva tests, offering 100% effectiveness with perfect use and 92% with typical use.

Keep an eye too on Canada’s Eli Health, which raised $12 m in 2025 to launch the world’s first instant hormone monitoring system. And UK-US start-up Level Zero Health which banked $6.9 million to develop its continuous hormone monitoring device - reportedly the largest pre-seed round in Europe ever for a female-founded team.

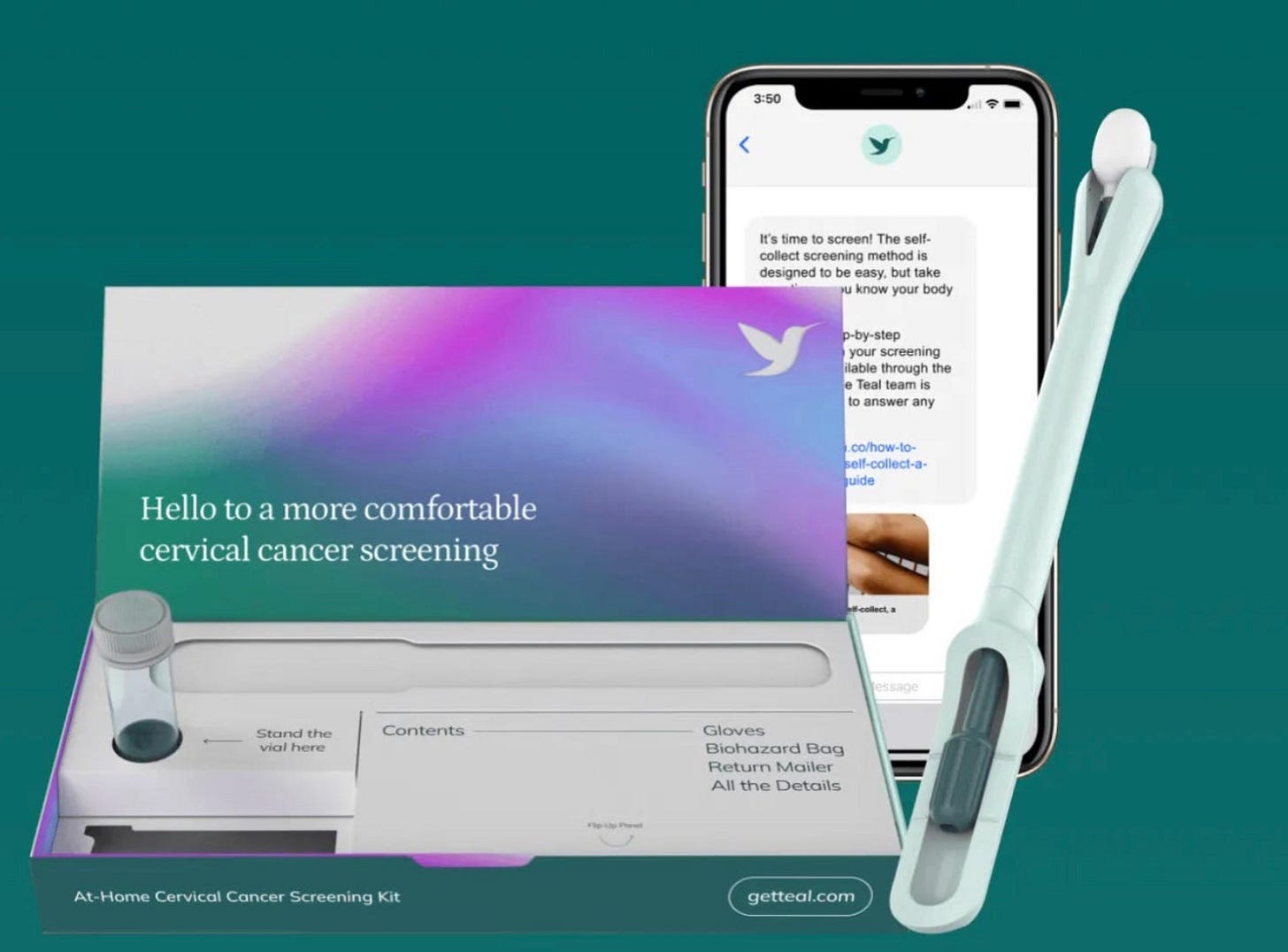

6. Diagnostics move into the home as American Cancer Society endorsed self-swab HPV test for cervical cancer screening

2025 marked a step-change in how women access preventative care. The American Cancer Society endorsed self-collection of vaginal samples for HPV testing in a new guideline. That was a major shift for cervical cancer screening where uptake of traditional methods can be low due to embarrassment, discomfort or simply inconvenience. This followed another milestone moment in 2025: the FDA approved Teal Health’s Teal Wand as the first at-home vaginal self-collection device for cervical cancer screening (HPV testing).

In the UK, the NHS announced it is to also offer at-home cervical screening and those who test negative for high-risk HPV will be screened every five years, rather than three.

Together, we’re seeing a shift towards decentralised diagnostics - with more autonomy and more convenience for women’s healthcare and setting the stage for more innovation in this area.

7. Fertility and maternal health remain foundational - and unresolved

While understanding of women’s health broadened significantly in 2025, fertility and maternal health are still foundational and are in no way ‘finished’.

In fertility, we’ve seen innovation accelerate - particularly thanks to AI. Conceivable Life Sciences secured a $18m Series A for its world-first automated IVF lab. Gameto raised $44million to advance ovarian support cell therapy to shorten IVF cycles.

Yet, demand for IVF is still growing and more innovation is needed. The next frontier is further upstream: earlier diagnostics, pre-IVF support and prevention strategies that could reduce the number of people ever needing IVF in the first place.

Maternal health meanwhile, is still in crisis - with devastating outcomes and poor patient experiences. The U.S scored a ‘D+’ in the latest March of Dimes report assessing preterm birth rates and maternal equity. Against this backdrop, Millie secured $12m Series A for midwifery-led, tech-enabled maternal healthcare. The hybrid maternity care company says it will scale through tech advancement and physical expansion. Its work is urgently needed.

8. Expanding definitions of women’s health as WellTheory raised $14m for autoimmune care

2025 reinforced that women’s health is not just reproductive health - it is lifelong health. WellTheory’s $14m Series A highlighted the scale of unmet need in autoimmune care. While WellTheory is not necessarily labeled ‘femtech’, around 70%-80% of its patients are female. The company reported 10x year-over-year member growth and 5x revenue growth as employers and payers increasingly recognise chronic conditions as core women’s health issues.

Elsewhere, startups tackling heart health (Systole), bone health (Skeletalis), menopause brain health (Prickly Pear) and autoimmune disease (Granite Bio’s $100m launch) show capital flowing into areas long overlooked in the women’s health conversation.

9. GLP-1s entered women’s health - and the cultural mainstream

Few areas of health generated more debate in 2025 than GLP-1s. Arguably the most visible moment was when Serena Williams fronted Ro’s campaign, openly discussing her use of GLP-1 medication after struggling with post-pregnancy weight. The campaign helped move the drugs beyond diabetes and obesity treatment into mainstream aesthetic and lifestyle use - especially for women navigating hormonal change after pregnancy.

The scale of the opportunity is highlighted by SheMed’s $50 million raise for its GLP-1 women’s health platform. At the same time companies like Noom, Alloy Health and Found Health began integrating GLP-1s into women’s health pathways - linking them to menopause, PCOS and metabolic health.

It may be controversial and there may be pushback, but GLP-1s are moving into women’s health because of demand, even as the clinical evidence specific to women’s health remains limited and is still catching up.

10. ŌURA’s $11 billion valuation was a win for women’s health - and the value of wearables

ŌURA’s $900 million funding round and $11 billion valuation was a milestone not just for wearables, but for women’s health. The majority of the Oura ring users are women, and the platform now underpins fertility, pregnancy and menopause care through integrations with Clue, Natural Cycles, Maven Clinic and more.

Oura’s success is an example of women’s health powering the growth of global consumer health platforms (Hims and Hers and Hone Health are other examples with fast-growing women’s health verticals within them) and also the importance of wearables in the ecosystem of women’s health.

11. Women’s sports as the catalyst in women’s health research: GG Ventures Fund II: sports, performance and longevity for women

London-based GG Ventures announced the first close of their Fund II at $30 million with a target final close of $100 million. While Fund I focused broadly on women’s health, Fund II turns towards “Sports” “Female Performance” and “AI-native Healthtech.”

Elite sport is increasingly acting as both a research catalyst and distribution channel for women’s health. FIFA-backed studies on the relationship between the menstrual cycle and ACL injury risk, alongside partnerships between women’s football teams and menstrual health brands, highlighted how performance environments (and the commercial opportunity of those!) are forcing a deeper understanding of female physiology. Women’s sport is accelerating the visibility, funding and scaling of research into women’s health.

12. FemTech faced a reckoning on privacy, platforms, censorship and scale.

2025 brought challenges and big questions for the sector as a whole. Flo Health headed towards an unprecedented jury trial over alleged data mishandling and Everlywell and Natalist settled a $5million privacy lawsuit over data sharing. In response to growing surveillance concerns, Comma raised a $2 million seed round to launch a hyper-secure period tracking app.

Meta’s sweeping restrictions on health advertising have disproportionately affected women’s health brands. The resulting censorship and digital suppression has been widely noted, with advocacy group CensHERship submitting a number of complaints to the EU’s Digital Services Act and releasing a comprehensive white paper outlining unignorable evidence.

This year’s issues show that trust and distribution in women’s health are absolutely critical.

13. Menopause regulation shifted to reset the standard of care

Menopause in 2025 has seen a boost from a range of - long overdue regulatory decisions.

The most significant came when the FDA removed the HRT ‘black box’ warning, reversing a 22-year-old decision stemming from the Women’s Health Initiative (WHI) study. For decades, this warning on HRT has shaped both clinician behaviour and patient fear, contributing to widespread under-treatment of menopausal symptoms.

The FDA also approved a new non-hormonal drug for hot flashes - Bayer’s Elinzanetant - aimed at women who don’t want to take hormones or are unable to. And in the UK, Ovesse became the first vaginal oestrogen cream to be sold without prescription, while the UK’s regulator the MHRA approved the first testosterone cream for postmenopausal women (following on from Australia, NZ and South Africa). (See more considerations on the ‘black box’ warning removal in Anastasiya’s article here). Also in the UK, the NHS announced that menopause questions and advice would now form part of free over-40 health checks.

Alongside this regulatory change we’ve seen more and more evidence of menopause moving into the mainstream: midlife-focused company Midi Health’s $50m Series C; Hims and Hers launched a dedicated perimenopause/menopause specialty; brands including Dove, Bayer Consumer Health and Nature’s Farm entered the menopause space; and the GenM ‘menopause friendly’ tick mark was adopted in Asia for the first time.

Together these changes show menopause significantly emerging from the shadows of silence and invisibility to become a more routine part of healthcare.

14. Longevity entered women’s health - on women’s terms

Beyond menopause itself, 2025 marked a broader reframing of longevity within women’s health. Until recently, the longevity conversation has largely been shaped by male-dominated narratives - from supplement stacks to biohacking culture and high-profile figures like Bryan Johnson.

In women’s health however, 2025 marked a turning point for shifting conversation. Growing recognition of ovarian ageing, the systemic impact of menopause and their links to cardiovascular, metabolic and brain health is now beginning to reposition longevity around female biology. Rather than performance optimisation, midlife is seen as the critical inflection point for longevity and therefore reclaiming the very word ‘longevity’ as meaningful for all women.

15. Funding signals for ‘taboo tech’

It’s tough out there to secure funding in women’s health - tougher still if your product relates to stigmatised areas of women’s bodies. This year, Lady Technologies raised a $6.5 million Series A to expand its vaginal health platform beyond fertility, while Pelva Health secured pre-seed funding to develop solutions for vulvovaginal pain and painful intimacy — conditions that remain poorly understood and under-treated despite their prevalence.

The raises may still be relatively modest, but they do show some investor and clinical willingness to invest in ‘taboo tech’ and a positive sign heading into 2026.

16. Biotech rounds in women’s health hit big

2025 has been rich in biotech rounds in the sector. Tubulis raised €308M for ovarian cancer treatment, making it the largest European biotech Series C ever. As mentioned in our fertility section above, Gameto closed a major $44M round to fund Phase 3 study of stem cells (engineered ovarian support cells) therapy to shorten IVF cycles. Sweden’s Gesynta Pharma raised $27.7M for a non-hormonal, non-opoid endometriosis treatment. The US’ Faeth Therapeutics landed $25M to advance its lead program in endometrial cancer. And Finnish TILT Biotherapeutics raised €22.6M for their intravenously delivered cancer immunotherapies, currently going to Phase 2.

All in all, a positive signal of confidence that women’s health can support the capital-intensive, late-stage biotech development.

17. Northern Europe and European policymakers made their move into women’s health

A flurry of activity this year concentrated in Northern Europe to focus in on women’s health policy. Copenhagen-based Nordic Women’s Health Hub launched the Nordic Charter for Women’s Health 2040 while a few months earlier the Danish government allocated DKK 160M ($23.4M USD) to establish a National Center for Women’s Health Research. Finland released the first official clinical guidelines on menopause and launched the Women’s Health Hub Finland. Ireland released a report Femtech in Ireland: The Case for Prioritising Women’s Health Research and Innovation - a result of two years’ work to identify significant opportunities for Ireland in technology, research, and innovation focused on women’s health. The Health Minister in the Netherlands launched a €27.5 M strategy to improve women’s health research.

These country efforts are aligned with the sentiment on the European level: the European Policy Center released a fundamental discussion paper, calling and advocating for the united women’s health strategy for Europe.

Known for fragmentation, 2025 shows early signs of co-ordination which should help with more sustained progress in women’s health.

Conclusion

By the end of 2025, women’s health no longer feels like a sector still making the case for its existence and worth. The focus has shifted - albeit unevenly - from proving the opportunity to beginning the work of building the systems that can really support it at scale.

Governments, philanthropy and private capital all saw movements - and meaningful ones - towards deployment rather than more debate about the opportunity in women’s health. That shift can be traced back to the McKinsey’s $1 trillion opportunity report released in early 2024, as well as the tireless grassroots work by founders, ecosystem players and advocates in women’s health for years previously and since.

Tailwinds, challenges and gaps remain of course. Political volatility, regulatory and reimbursement hurdles, investment hesitation at all levels and a lack of scaleups in Series B+ rounds continue to shape what might be possible.

But the overriding question heading into 2026 is no longer whether women’s health matters. It is instead where investment, regulation and innovation can have the greatest impact.

We’ve passed the inflection point in women’s health and the foundations have begun to take shape. In 2026 the job becomes keeping up the momentum.

Thank you for this really interesting overview. I learned a lot!

Outstanding synthesis of the inflection point we're seeing in women's health infrastructure. The shift from proving the $1 trillion opportunity to actually building systems is huge. The IVF section caught my eye, Conceivable and Gameto getting serious funding for automation and cycle shortening is necesary, but I agree the real frontier is upstream diagnostics and prevention. Also appreciate calling out the privacy reckoning seperately, Flo and Everlywell cases show how fragile trust is when data handling gets loose.