💌 Issue 132: Midi Health's $100m raise | $50m for sports & performance institute | EU women's health strategy a step closer

The global weekly briefing on women's health innovation and Femtech

Welcome to issue #132 of FutureFemHealth, (w/c Feb 2 2026) — the global weekly briefing on women’s health innovation, trusted by 9,000+ investors, innovators and leaders.

Another huge week - a new unicorn in women’s health, EU women’s health policy progress and a number of consolidations too. In fact, there’s so much to cover that this email may be too long to read - so please click to open in your browser if it gets cut off!

🌟 In this week’s briefing:

🔥 Midi Health announces $100 million Series D round.

💰 Origin raises Series B funding to scale pelvic floor physical therapy nationwide.

💪🏼 $50m funding for new Women’s Health, Sports & Performance Institute.

📈 A step closer to an EU women’s health strategy.

This week’s newsletter is powered by the Women’s Health Executive & Research Summit (HERS)

HERS Summit is the premier event focused on advancing women’s health through innovation, investment, and care delivery. Join leaders shaping solutions, closing research gaps, and driving real outcomes across the women’s health ecosystem. Register by February 20 to save up to $100 and secure your spot:

🔥Menopause just became the billion-dollar proof point for women’s health

The U.S women’s telehealth company Midi Health has raised $100 million in a Series D round, taking the company to a $1 billion valuation.

It’s a milestone moment. Yet, just five years ago (Midi Health was founded in 2021), the idea of a menopause-focused unicorn would have seemed very unlikely.

Women’s telehealth was still emerging, and menopause itself barely registered as a serious commercial or clinical market. There were only a handful of dedicated startups, such as Elektra Health and Vira Health, and little sense that menopause could ever scale. The shadow of the Women’s Health Initiative (WHI) study still loomed large, creating fear and confusion about hormone therapy (which still persists to this day).

Culturally though, something was beginning to shift. In 2020, Michelle Obama spoke openly about experiencing hot flashes; Oprah Winfrey reframed menopause as a moment of reinvention.

In the five years since Midi Health has launched menopause has moved onto policy agendas. Employers have added it to benefits packages. More celebrities have spoken up. Telehealth is a normal part of care delivery. Dozens more startups have entered the space.

Most importantly, women have been much more vocal about what they need.

Midi Health arrived just as this all began to change - although, of course, timing alone doesn’t create unicorns and its success was not inevitable.

What Midi has done is built a care model that works with healthcare systems, and provides longer term support to women as a one-stop-shop during midlife. It serves 25,000 patients a week and is insurance-covered in all 50 states. As one investor praised:

“Midi’s rise as the fastest-growing women’s health platform is a testament to their care team, patient-centric approach and AI-enabled personalisation.”

And, what’s happened in the menopause space is a pattern also highlighted in the recent World Economic Forum / BCG report, which included a case study on IVF. While IVF was once dismissed as niche and elective it is now a global, multi-billion-dollar sector embedded in mainstream healthcare.

Menopause appears to be undergoing the same transition. And Midi Health’s success is the proof point for that - and for women’s health more broadly.

It’s a clear signal that women’s health can be a scalable, system-shaping market.

As for Midi, as co-founder and CEO Joanna Strober explains:

“Women’s health has been treated like an afterthought for too long. This funding gives us the resources to rewrite that story at scale.”

(Continue reading: FutureFemHealth - and below in capital flows)

💰 Capital flows

📌 U.S Midi Health raises $100m Series D at $1 bn valuation. Following our lead story above, this funding marks one of the largest recent raises in women’s digital health. This round was led by Goodwater Capital. (Continue reading: FutureFemHealth)

📌 U.S: Origin raises Series B funding to scale pelvic floor physical therapy nationwide. Pelvic floor therapy has traditionally meant high out-of-pocket costs and limited access - despite affecting more than a third of women (rising to over half of women over 55 years old). Origin has flipped the model by positioning pelvic floor care alongside standard musculoskeletal (MSK) therapy, delivering 95% of its care in-network - with most patients paying under $36 out-of-pocket per visit. Physician referrals have jumped to 10,000 in the past year, up from 1,500 at the start of 2024 - a positive sign that the strategy is translating into adoption. This round was led by SJF Ventures - no funding amount was disclosed. (Continue reading: FutureFemHealth

📌 U.S / GERMANY. Sword Health acquires Kaia Health in $285m MSK expansion play. As the Origin story above shows, musculoskeletal (MSK) care is fast becoming a core platform with growing potential to also scale women’s and pelvic health services alongside it. This deal brings together Sword Health’s AI-first MSK footprint across the U.S and Germany, with Kaia Health’s large European user base and Germany’s national digital health reimbursement system. Kaia has previously made targeted moves into women’s health - expanding its pelvic floor therapy and menopause education through partnerships such as Vira Health. (Continue reading: FutureFemHealth)

📌 UK/ IRELAND: Orreco doubles down on women’s performance with Jennis acquisition. With $4m in fresh funding, Orreco has acquired Jennis, co-founded by British Olympian Jessica Ennis-Hill. Orreco’s flagship product FitrWoman is already used by more than 25 Olympic medallists — and by embedding Jennis’s IP on the personalised impact of hormonal cycles, the company is expanding from cycle-aware insights into a broader performance intelligence layer. Orreco says the combined platform will form “the most advanced women’s performance ecosystem in the world”; the more meaningful takeaway here is that female physiology is being treated as core performance data, not context. Deal terms were not disclosed. (Continue reading: Silicon Republic)

🌟 Industry moves and strategic shifts

📌 U.S: $50m funding for new Women’s Health, Sports & Performance Institute. Women’s sport is now big business — but the science behind it is lagging badly. Revenue is growing 4.5× faster than men’s, sponsorships 50% faster, yet fewer than 1 in 10 studies are built around female physiology. This new $50m-backed institute wants to close that gap. The real upside, though, isn’t just better-performing elite athletes — it’s whether this long-overdue research could trickle down into how all female bodies are understood, trained and treated far beyond professional sport. (Continue reading: FutureFemHealth)

📌 U.S: Gameto secures crucial Harvard research as it bids to build human ovary in a dish. By licensing new genetic tools from Harvard, Gameto can now trigger the earliest step needed for egg formation, known as meiosis. The advance could help accelerate drug discovery for conditions including infertility, early menopause and primary ovarian insufficiency, where treatment options have historically been limited. “Adding the ability to induce early meiosis allows us to study stages of ovarian biology that have largely been out of reach until now.” said Dr Christian Kramme of Gameto. (Continue reading: FutureFemHealth)

📌 GLOBAL: Maven Clinic launches Clinical Research Institute to showcase impact of digital care models. Maven argues that while virtual healthcare has rapidly grown, it’s not yet held to the same scientific standards as traditional healthcare nor are there consistent benchmarks. This new Institute positions Maven as the evidence engine for the entire sector - it will examine how digital care models affect clinical outcomes, costs, and access for women and families. The effort builds on what the company describes as one of the world’s largest datasets on women’s and family health delivered through virtual care, drawn from supporting more than 28 million lives globally. An inaugural report examines how Maven’s model benefits underserved populations - for example finding that Black members who met with a Maven doula at least twice had a 56 percent lower risk of cesarean delivery (Continue reading: FutureFemHealth)

📌 U.S: The Women's Health Executive & Research Summit (HERS) wants to turn women’s health momentum into outcomes. The HERS Summit, taking place in San Diego next month, March 23-24, is betting that the real blocker in women’s health isn’t ideas, it’s coordination (hear, hear!). By bringing together investors, innovators, scientists, clinicians and health system leaders under one roof, it aims to close the gaps that keep promising science from reaching women at scale. The momentum is undeniable in women’s health - now HERS will be testing whether the ecosystem can turn that into measurable impact. (Continue reading: FutureFemHealth - partner content)

📌 AUSTRIA: Menotracker launches menopause tracking app with pseudonymous data architecture. Menotracker intends for its ‘privacy is consent’ approach to reduce the risk of sensitive menopause data being shared, sold or disclosed, either commercially or through legal processes. It’s teamed up with a tech company so that users are assigned pseudonyms in the app and a user’s true identity cannot be accessed. After prominent legal cases involving femtech companies such as Flo Health, and examples of U.S authorities tracking devices to monitor abortions, Menotracker is betting that data privacy is a deciding factor for consumers tracking their menopause symptoms too. (Continue reading: FutureFemHealth)

Have your say in this week’s poll:

Last week’s poll asked: Where do you think women’s health can scale the fastest in the next five years. By a long margin, 69% of you said it would be a through a hybrid of consumer and clinician tools.

🩸 Research and women’s health news

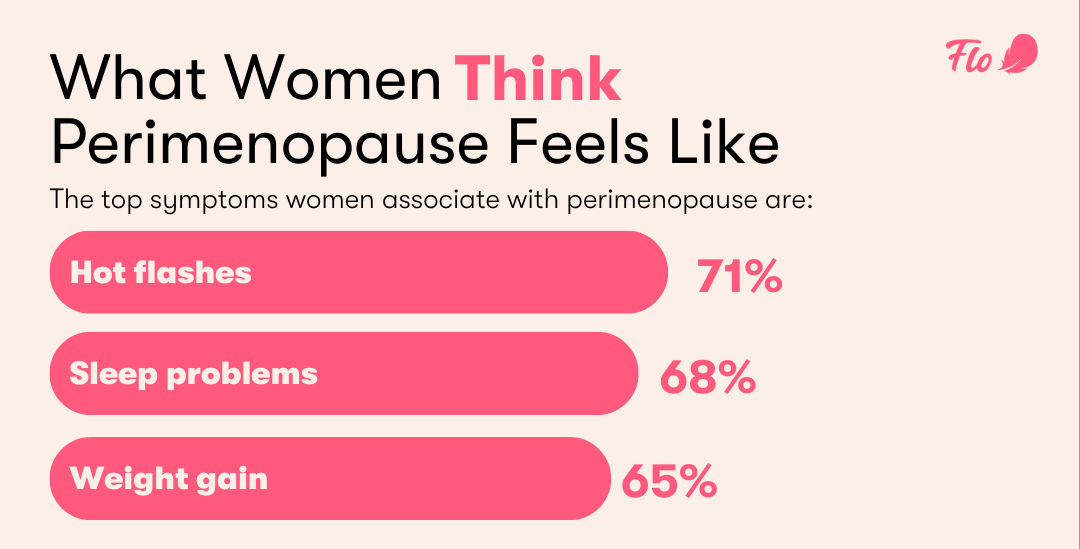

📌 GLOBAL: Flo Health and Mayo Clinic publish first global digital study on perimenopause awareness — and the US lags behind. Flo Health has access to one of the largest data sets in women’s health (there were 9.09m app installations in January alone). Now Flo is teaming up with Mayo Clinic to identify and share insights, finding that American women rank only sixth globally for overall knowledge of perimenopause symptoms, trailing peers in the UK, Ireland, Canada, Australia and the Netherlands. This gap matters because perimenopause often begins years before menopause itself - and symptoms can be misattributed, dismissed or missed entirely. Tying this back to our Midi Health lead story, this is also an example of how much opportunity there still is in the women’s health space to educate on menopause and help women to access the care that they need. (Continue reading: FutureFemHealth)

📄 Policy watch: risks and opportunities

📌 EUROPE: One step closer to an EU women’s health strategy. Yesterday in the European Parliament a coalition of 50 organisations formally launched a blueprint for a much-anticipated EU women’s health strategy. Led by the European Institute of Women’s Health and with input from health organisations, policymakers and advocates, the document sets out the priorities, principles and policy recommendations intended to inform a future, official strategy. While healthcare delivery remains a national responsibility, many of the drivers of women’s health — from research funding to regulation and digital markets — sit at EU level. An EU strategy is intended to align and support national action, rather than replace it, and importantly to address gaps that individual countries cannot tackle alone. As EIWH director general Peggy Maguire said during the event: “The question is no longer whether women’s health deserves coordinated EU action,” she said. “It is how quickly we are willing to act on it.” (Continue reading: FutureFemHealth)

📌 INDIA: Landmark ruling as Supreme Court mandates free period products in schools. For years, access to period products and safe, private toilets in Indian schools has depended on patchy state schemes and goodwill. This week, the Supreme Court changes that by declaring menstrual hygiene a fundamental right, issuing binding directions to states, Union Territories and Schools. (Continue reading: Times of India)

📆 Save the date

📌 9th annual Black maternal health conference: Virtual, April 10-11, 2026. There is a real urgency to disrupt the status quo in maternal health - particularly the Black maternal health crisis. This conference seeks to raise awareness, inspire activism, and encourage community building. 🎟️ Register now.

📌 Women’s Health Executive & Research Summit (HERS): San Diego, March 23-24. Register by February 20 to save up to $100 and secure your spot. 🎟️ Register now.

📌 The Women’s Domain: CensHERship and the Femtech Economy. Navigating the digital barriers in women’s health. London, Thursday 26 Feb, 6pm GMT. London Bridge. (I’ll be joining my CensHERship co-founder Clio Wood to speak at this one!) 🎟️ Register here.

✅ Hiring now

📌 U.S: Senior Program Officer, Gates Foundation

📌 U.S: Senior Strategy Officer, Gates Foundation

📌 U.S: Senior Director of Growth and Patient Acquisition, Salvo Health

That’s all for this week! If you’ve missed any previous newsletter issues catch them all at futurefemhealth.com and do make sure to follow us on LinkedIn and you can connect with me directly.

Anna

Before you go: Want to partner with us? To explore opportunities or request our media pack contact: anna@futurefemhealth.com

Congrats and brava to Midi Health. This is a huge win for women's health. I've followed (and envied) Midi as I worked for competitor Gennev, which was one of the original telehealth specialty menopause platforms. Sadly, the pioneers in a category rarely become the unicorns. Shout out to Jill Angelo and Dr. Rebecca Dunsmoor-Su, who built Gennev and turned it into an incredible telehealth clinic (with an exit to Unified Women's Healthcare). I still believe Gennev's care model of OB/GYN + RDN is superior to Midi's but what's most important is that more women have access to specialty menopause care.

Brillant analysis of how Midi Health becamethe menopause unicorn. The parallel between IVF's journey and menopause care evolving from niche to mainstream is really insightful. I saw a similar pattern when working on healthcare access research last year where taboo topics suddenly got traction once systems embraced them. Menopause isn't jus a market opporunity its overdue infrastructure.